FOR SALE

+92-300-1900991

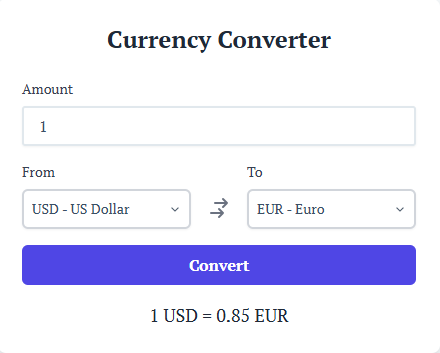

If you’ve ever planned a trip abroad or needed to send money to family overseas, you’ve probably wondered about getting the best deal on your exchange. A currency converter is your essential tool for understanding how much your money is worth in another country’s currency. Think of it as a calculator that helps you see the real value of your dollars, euros, or pounds when you’re dealing with foreign exchange. This online service has become indispensable for anyone involved in international transactions, whether you’re booking a hotel, shopping on a global website, or planning a remittance back home.

When you look up a currency exchange rate today, you’ll often see what’s called the mid-market rate—this is the real-time rate that banks and large institutions use when trading with each other, also known as the interbank rate or spot rate. However, the customer rate you actually get is usually different because money exchange services add a markup or spread to make their profit. The rate difference between these two can significantly impact your transfer, especially when you’re sending larger amounts. Most traditional banks apply a substantial commission on top of the market rate, which means you’re paying more than the published rate you see in the news. Understanding this rate differential helps you make smarter decisions—I learned this the hard way when I sent money overseas without comparing options and lost a considerable amount to hidden fees and poor exchange rate margins.

Ready to send money? The key to saving on international transfer costs is knowing how to send your money at a good rate. Start by comparing the current rate across different transfer service providers—some online money transfer platforms offer rates much closer to the live rate than traditional banks. Look for services with transparent fee structure and minimal spread, and always check both the exchange rate and any transfer fees before committing. Timing matters too: currency values fluctuate constantly due to rate volatility, so monitoring the forex rate for a few days can help you catch a favorable rate. I’ve found that using a digital currency conversion tool to set rate alerts makes exchange rate optimization much easier, especially for larger remittance amounts where even a small improvement in the conversion rate can mean significant savings.

Whether you prefer online convenience or need a physical exchange location, options abound for currency exchange. Searching for “currency exchange near me” will show local forex offices, money changer services, and exchange bureau locations where you can walk in with cash. However, these brick-and-mortar exchange counters and currency kiosk setups typically offer less competitive rate options compared to digital payment platforms. For cross-border payment needs, electronic funds transfer through specialized money transfer services often provides better value than wire transfer through banks. The latest rate information is always available through currency calculator apps that show the current conversion rate and help with rate comparison. Modern peer-to-peer transfer platforms have revolutionized how we handle overseas transfer transactions, offering low-cost transfer solutions that were unimaginable just a decade ago.

The value proposition of today’s currency conversion service providers lies in their transparency and competitive advantages. Unlike older commercial rate systems that hid costs in confusing pricing difference structures, modern services clearly display their fee reduction strategies and service features. Their customer benefits include real-time rate updates, no hidden charges, and significantly better trading rate options than traditional bank rate offerings. The compelling reasons to choose these newer platforms extend beyond just cost-effective transfer options—they offer superior user experience, faster processing times, and better currency pair coverage. When evaluating your options, consider the selection criteria that matter most: the present exchange rate they offer, their transfer method flexibility, and their track record for reliable fund transfer services. These key benefits and service highlights make the decision factors clear for anyone looking to maximize their money’s value in the FX market.